Japan in a recent Automobile show showcased some exquisite and eye-catching cars. The main objective of the show was to announce to the world that, Japanese EVs are about to take the world by a tsunami. Takero Kato, Chief Executive of EV segment in Toyota couldn’t stop repeating ‘We love battery EVs’. The main competitors in EV market for Japan are, Tesla and BYD.

The Nissan Hyper Force Concept car is displayed at the Japan Mobility Show 2023 at Tokyo Big Sight in Tokyo on Wednesday. Photo: REUTERS

The Nissan Hyper Force Concept car is displayed at the Japan Mobility Show 2023 at Tokyo Big Sight in Tokyo on Wednesday. Photo: REUTERS

The one thing everybody admires about Japan is their love for their home-grown brands. This is the exact reason why no foreign companies are able to operate in Japan. US automakers like General Motors Co and Ford Motor Co aren’t exhibiting at the show and have not taken part for some years. The Americans make up a very tiny fraction of Japanese auto sales and have had a hard time cracking a market where domestic makers remain powerful. Among the foreign makers taking part are Mercedes-Benz, a perennial Japanese favourite, and China’s BYD. Japan always known for making time-stopping race-cars like Subaru are transitioning in EV mode and the world might not be ready for it.

Japan’s transition to EV

The Government of Japan (GOJ) recently set a target: by 2035, all new cars sold will be environmentally friendly. In Japan, eco-friendly cars are called Clean Energy Vehicles, or CEVs, to differentiate from fossil fuel-based vehicles. The GOJ is offering to subsidize part of the cost to purchase CEVs, such as Battery Electric Vehicles (BEVs), Plug-in Hybrid Electric Vehicle (PHEVs) and Fuel Cell Electric Vehicles (FCEVs). The maximum amount of the CEV subsidies given per vehicle in 2021 is 800,000 Japanese Yen, which is about 7,200 US Dollars. Although Hybrid Electric Vehicles (HEVs) are considered eco-friendly cars, these are not eligible for the CEV subsidy program.

According to the Japan Automobile Dealers Association (JADA), sales of new electric vehicles in 2020 reached close to 1.4 million. New electric vehicles accounted for 36.2% of total new car sales, up from 35.2% in 2019, and 32.9% in 2017. Japanese market demand for HEVs has been strong since the Toyota Prius was first introduced here in 1997. In fact, 97.8% of the new electric vehicle sold in 2020 were HEVs, followed by PHEVs 1.1%, BEVs 1.1% and FECVs 0.1%.

Japan is transitioning to 100% electric car sales by 2035 and the Japanese electric vehicle market is growing. U.S. companies may find business opportunities in various areas related to electric vehicle such as, Lithium-ion Batteries, Solid-State Batteries, Battery Management & Analysis, Vehicle-to-Grid (V2G) Technology, End-Life Battery Technology, and Charging Infrastructure Development.

The Japanese EV market will definitely hurt the Chinese EV domination as they will be cost effective and more sportier in design as to the Chinese made EVs. Companies like Nissan, Toyota, and Mazda are household names for everyone around the globe.

Among all these giants, Suzuki wants to make EV cars as well. Cars like Swift and Grand Vitara are expected to have an EV variant in the coming years. Suzuki wants to export these cars to India, their biggest market.

Opportunities galore for Japanese EV market

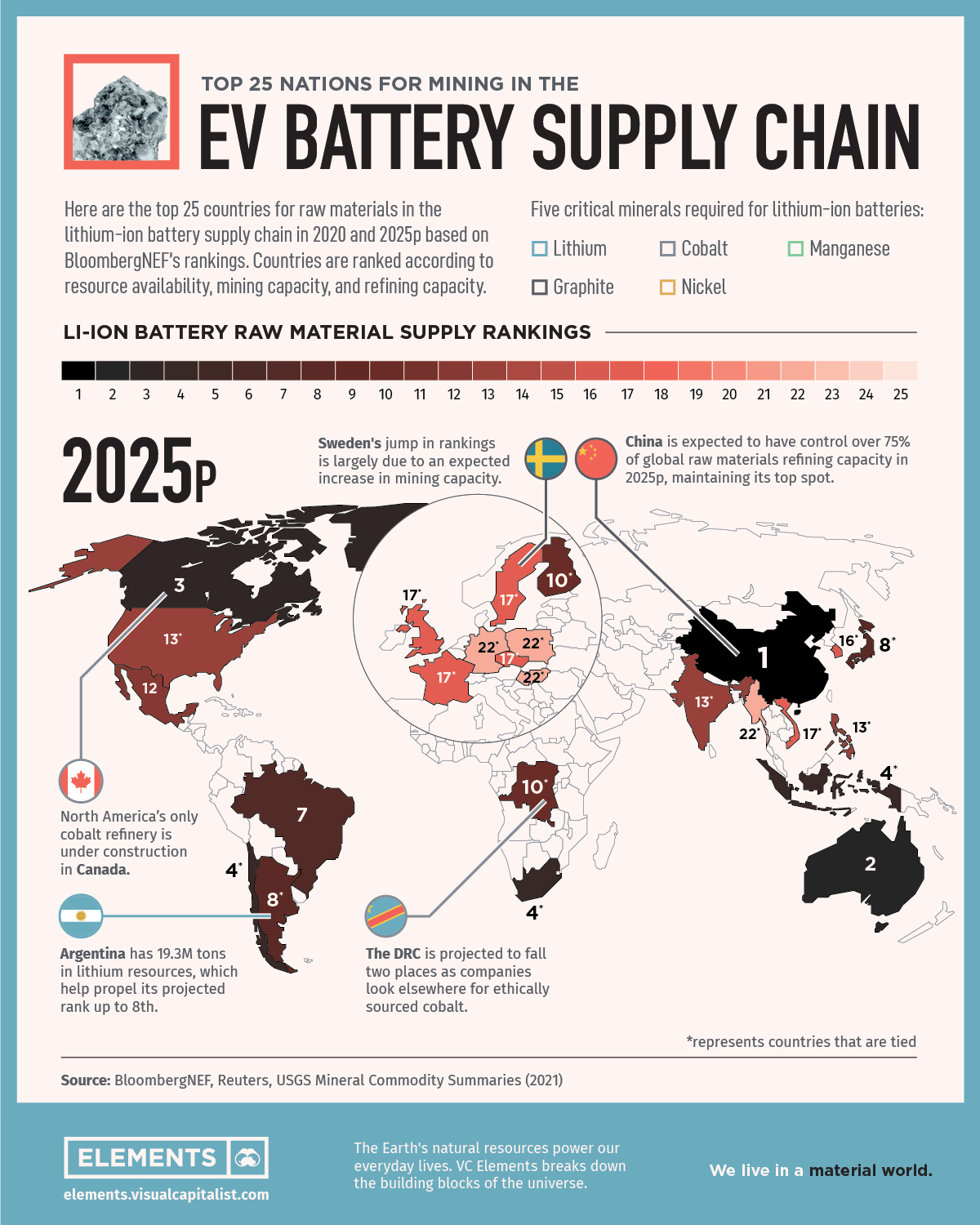

After the recent curb of graphite move from Beijing, Japan has set its eyes to procure the EV battery. “There are risks involved in every kind of material, not only graphite. We want to procure resources while considering various risk hedges,” Atsushi Osaki told reporters on the sidelines of the show, which opened to the press on Wednesday, a day ahead of its official start. The companies are potentially eyeing to create an EV battery monopoly similar to what China and USA have done. Japan’s government plans to work with three African nations to develop supply chains for cobalt and other minerals critical in making electric vehicle batteries.

Japan has recently created more demand for their cars when compared to the USA. China only remains a tough block to overcome for the EV industry in Japan. The country looks to diversify its sources of critical minerals, including lithium, in order to enhance economic security and counter China’s growing investment in African countries. Chinese enterprises have invested heavily in Africa, especially in Congo. As a result, China has quickly expanded its market share in processing critical EV minerals. If China restricts exports in response to tensions with the U.S., it would impede efforts by Japan and Western nations to bring EVs into the mainstream and reduce carbon emissions.