Huawei Technologies Co. the Chinese gadget manufacturer giant was crippled by the USA in their bid to win the semiconductor battle. Fast-forward 5 years and we see China relying on Huawei to compete with the world’s semiconductor chip battle; a war that will shape many major economies for the decades to come.

Huawei’s role in China’s chip industry goes far beyond what’s been previously reported. As well as being the most important customer for chip producers and the country’s leading chip designer, Huawei is increasingly lending engineering expertise and financial support to smaller companies in strategic areas of the chip supply chain. It often does this without disclosing its involvement — which would trigger US restrictions.

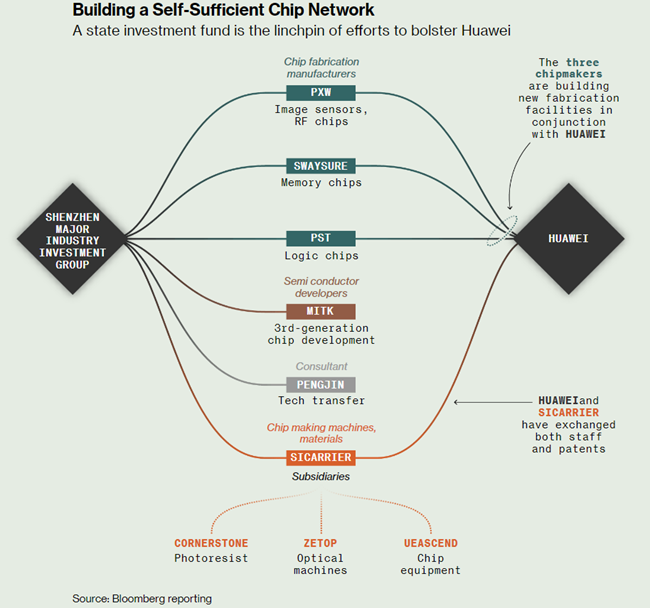

State support for the company has also reached unprecedented levels. Bloomberg News has uncovered a network of enterprises backed by a Shenzhen city government investment fund, which is focused on helping Huawei build a self-sufficient chip network.

This group includes optical specialists, chip equipment developers and chemical manufacturers. This is in addition to the $30 Billion state-sponsored endeavour to help Huawei build chip fabrication facilities Bloomberg News first reported on in August.

“Huawei is now the centre-point,” said Kendra Schaefer, a partner at Beijing-based consultancy Trivium China. “The export controls have pushed the state and industry together in a way we haven’t seen before.”

Huawei denied that the government is giving it support to develop semiconductor technologies. “This is entirely speculation and conjecture based on information online,” the company said in a statement.

More about China’s decision to make Huawei its semiconductor captain

The decision to make Huawei the effective captain of China’s effort to develop a self-sufficient chip industry is the result of a direct order from the top of government, according to people familiar with the matter who asked not to be named due to the sensitivity of the topic.

In Huawei, they have a rare national champion with the grit, scale and technological prowess to push back. Founded in 1987, the company first made its mark in the communications equipment industry before it later expanded into mobile phones. And its combative founder Ren Zhengfei was preparing for disaster years before it struck.

Huawei has long kept a group of black swans on its main campus as a reminder to avoid complacency and prepare for unexpected crises.

More than a decade ago, when business was booming, Ren told engineers that continued investment in semiconductor research was the only way to head off a mortal threat to the company. “We can’t just let others to choke us and die just because of that one product,” Ren said.

What are semiconductor chips and why is there a political race for it?

In simple terms, semiconductor chips play a vital role in enabling the functionality of the systems and products we rely on every day for communication, automobile, entertainment, game controllers, etc. They are an essential component in most electronic devices, spanning various industries.

A semiconductor chip, also known as an integrated circuit (IC) or microchip, is a small electronic device made from a semiconductor material such as silicon. And fascinating part is they can handle multiple tasks such as processing, memory, storage, logic control, digital communication, sensing & detection, and power management.

The global race for semiconductor investment and future dominance has reached unprecedented levels, with major players such as Samsung Electronics, Intel, Micron Technology, and other companies investing billions of dollars to solidify their positions.

Simultaneously, several countries are implementing strategic plans to secure their semiconductor fabrication capacities and reduce reliance on other nations.

This intense competition is set to reshape the semiconductor industry and determine the global balance of power in cutting-edge technologies.

Disruption to the semiconductor industry received perhaps the most publicity, after all these tiny little computer chips have such a wide-ranging application over all other industries.

The global chip shortage that emerged in 2021 (followed by 2022) was a result of the pandemic’s onset. Large automotive companies canceled chip orders due to a sudden drop in consumer demand, as the world went into lockdown.

Consequently, chip manufacturers retooled their plants to cater to the increased demand for consumer electronics, personal computing, home fitness machines, and other related products.

However, as stay-at-home orders were gradually lifted, global automobile demand surged, catching chip manufacturers off guard. They were unable to keep up with this sudden increase in demand, leading to a massive chip shortage during that time.

The catastrophic shortage of these next generation gadgets actually created a new height of demand and a news arms race. USA wants to contain China of their chip facilities in order to control them defensively.

How intertwined Huawei and Beijing are in this semiconductor chip race?

To have a closer look at their relationship; Huawei’s latest mobile piece Mate 60 Pro Smartphone is the perfect instance. Huawei timed the release of the phone to coincide with US Commerce Secretary Gina Raimondo’s visit to China in part because of direct encouragement from a senior official at the top of the regime, according to a person familiar with the situation who asked not to be identified discussing sensitive matters. They’d decided it was time China showed some muscle, the person said.

The significance of the phone was the high proportion of advanced home-grown components it contained, in particular a 7-nanometer processor from Shanghai’s Semiconductor Manufacturing International Corp.

Hailed by state press as a patriotic triumph, it sparked fervent debate within the US about whether its efforts to slow China’s technological advance were falling short.

A teardown conducted for Bloomberg News found the majority of components in Huawei’s Mate 60 were made in China

The concern in Washington is that the advanced semiconductors that power Huawei’s smartphones could also be used for military applications, such as AI-controlled drones or super computers for code-breaking and surveillance.

The US is determined to contain China’s defence capabilities as tensions between the two countries rise over issues including the future of Taiwan.

Huawei is just the tip; Analysts predict China to keep pouring billions in the semiconductor chip race

Many experts see China pouring billions of dollars in the pursuit to win this semiconductor race and also advance further in AI hegemony. The consequences of being left behind could be fatal to its ambitions in fast-growing fields like AI.

The scale of the subsidies is massive, far beyond what people would usually think,” said Dylan Patel, founder of the research group SemiAnalysis. “They’ll build apartment buildings, help with land and take no income taxes.”

China doesn’t have to establish self-sufficiency at each step of the semiconductor supply chain. The key is to create domestic alternatives at four or five steps of the process where the US and its allies can choke off supplies, says Clifford Kurz, an analyst with S&P Global Ratings.

That means China — and Huawei — will likely focus on concentrated sectors like lithography, wafer production and electronic design automation, or EDA.

“The key thing for Beijing is to have progress in these critical stages,” Kurz said. “They have done analysis of the whole supply chain since at least 2014. The purpose of the funding is to invest where they think they can have the most impact.”