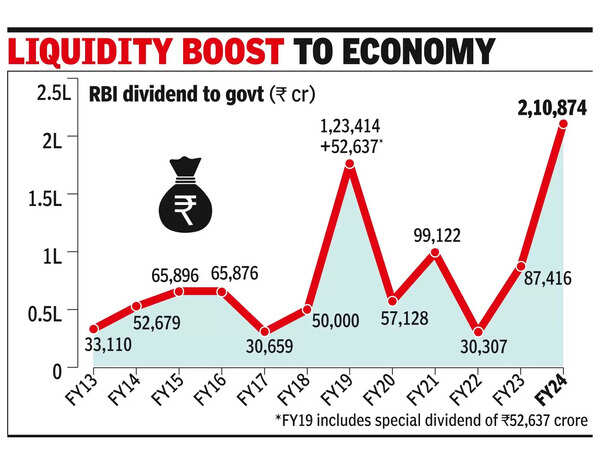

The Reserve Bank of India (RBI) has made a landmark decision to transfer a record Rs 2.11 lakh crore surplus to the central government for the fiscal year 2023-24. This amount significantly surpasses the Rs 87,416 crore paid in the previous year, more than doubling the previous dividend and offering a substantial boost to government finances. This windfall is expected to ease the fiscal deficit by 0.4% in FY2025, allowing for enhanced expenditures and a more aggressive approach to fiscal consolidation. Economists see this transfer as a crucial development for the government’s financial planning and economic strategy.

Boost to Fiscal Resources and Spending Potential

The transfer of Rs 2.11 lakh crore is a remarkable increase over what was anticipated in the interim budget, which had projected Rs 1.5 trillion for dividends and profits. The higher-than-expected surplus provides a significant financial cushion for the central government. Economists attribute this windfall to a combination of factors, including higher interest rates on both domestic and foreign securities, a substantial gross sale of foreign exchange, and more controlled liquidity operations compared to the previous fiscal year.

Upasna Bhardwaj, chief economist at Kotak Mahindra Bank, pointed out that the higher interest rates have likely played a major role in boosting the RBI’s profits. Additionally, the limited drag from liquidity operations, as compared to the previous year, has helped in accumulating a larger surplus. Bhardwaj emphasized that this large transfer could ease the fiscal deficit by 0.4% in FY25, providing the government with more breathing room to maneuver financially. This reduction in the fiscal deficit could also mean lower borrowing needs, which in turn could lead to a more stable economic environment with potentially lower interest rates.

Aditi Nayar, chief economist at ICRA, echoed these sentiments, stating that the substantial RBI surplus transfer would significantly enhance the government’s resource envelope in FY2025. This increased resource availability allows for either greater expenditures or a sharper fiscal consolidation than what was initially budgeted. Nayar highlighted that while this unexpected windfall increases the government’s spending power, the challenge lies in efficiently utilizing such a large sum within the remaining eight months of the fiscal year after the final budget is approved. The timing of the transfer poses a logistical challenge for the government to ensure that the funds are allocated and spent effectively to maximize their impact.

Challenges and Strategic Spending

Despite the clear financial benefits, there are challenges associated with the timing and utilization of the surplus. Nayar pointed out that the government has only about eight months after the final budget approval to efficiently utilize the surplus. This short window could make it difficult to plan and execute additional spending projects, particularly large-scale capital expenditure initiatives that require significant planning and implementation time. However, she also noted that increasing the funds available for capital expenditure could improve the quality of the fiscal deficit. Capital expenditure, which involves spending on infrastructure and other long-term investments, tends to have a more lasting positive impact on the economy compared to other types of spending.

Vivek Kumar, an economist at QuantEco Research, added that the surplus provides a fiscal cushion of 35-40 basis points of GDP. This cushion can be particularly valuable in covering potential revenue losses, such as shortfalls in disinvestment proceeds, or creating additional room for spending on critical areas. Kumar emphasized that this windfall comes at a crucial time, providing the government with the flexibility to address unforeseen financial challenges without significantly increasing the fiscal deficit.

The government has outlined a fiscal glide path aiming to reduce the fiscal deficit to 4.5% of GDP by 2025-26. The interim budget presented in February set the fiscal deficit target for FY25 at 5.1% of GDP. This surplus transfer from the RBI plays a pivotal role in achieving these targets. Madan Sabnavis, chief economist at Bank of Baroda, noted that the past three months have been relatively sedentary in terms of government expenditure, with no major slippages reported. This controlled spending behavior, combined with the RBI’s substantial surplus transfer, positions the government well on its fiscal consolidation path.

Impact on Borrowing and Interest Rates

Another significant aspect of the RBI’s surplus transfer is its potential impact on government borrowing and interest rates. With the additional funds, the government may not need to borrow as much as initially planned. This reduction in borrowing needs could help stabilize or even lower interest rates, which would have positive implications for the broader economy. Lower interest rates can stimulate economic growth by making borrowing cheaper for businesses and consumers, encouraging investment and spending.

The central government had announced plans to borrow 53.07% of its full-year target in the first half (April-September) of FY25. The gross borrowing for the first six months of FY25 was set at Rs 7.5 trillion out of a total borrowing target of Rs 14.13 trillion. With the higher-than-expected surplus transfer from the RBI, there is potential for these borrowing plans to be revised downwards. Kumar highlighted that a reduction in government securities borrowing requirements could help guide interest rates lower, providing further economic benefits.

RBI Long-term Fiscal and Economic Implications

The record surplus transfer from the RBI is not just a short-term financial boost but also has significant long-term implications for India’s fiscal policy and economic health. By easing the fiscal deficit and reducing the need for additional borrowing, the government can focus on more sustainable economic policies. This can include increased spending on infrastructure, education, and healthcare, which are critical for long-term economic growth and development.

Furthermore, the transfer reinforces the importance of maintaining a healthy and profitable central bank. The RBI’s ability to generate such a significant surplus highlights the effectiveness of its monetary policies and financial management. It also underscores the importance of having a strong and independent central bank that can support the government’s fiscal needs without compromising its primary objectives of controlling inflation and ensuring financial stability.

the RBI‘s decision to transfer a record Rs 2.11 lakh crore surplus to the central government is a significant development with far-reaching implications. It provides immediate fiscal relief, reduces borrowing needs, and offers the potential for enhanced spending on critical areas. While there are challenges associated with the timing and efficient utilization of the funds, the overall impact on the fiscal deficit and economic stability is overwhelmingly positive. As the government navigates the remainder of the fiscal year and plans for the future, this surplus transfer will play a crucial role in shaping India’s fiscal and economic landscape.