Whirlpool of India ltd. shares declined 3% in early trade on December 1 after its holding company sold up to 24% stake in the company. This comes after Whirlpool Corporation announced its intention to enter into one or more transactions to sell up to 24% of its ownership interest in Whirlpool of India Limited in 2024.

“The company maintains a 75% ownership interest in Whirlpool India through a wholly-owned subsidiary, and intends to retain a majority interest in Whirlpool India following completion of such transaction or transactions,” it added.

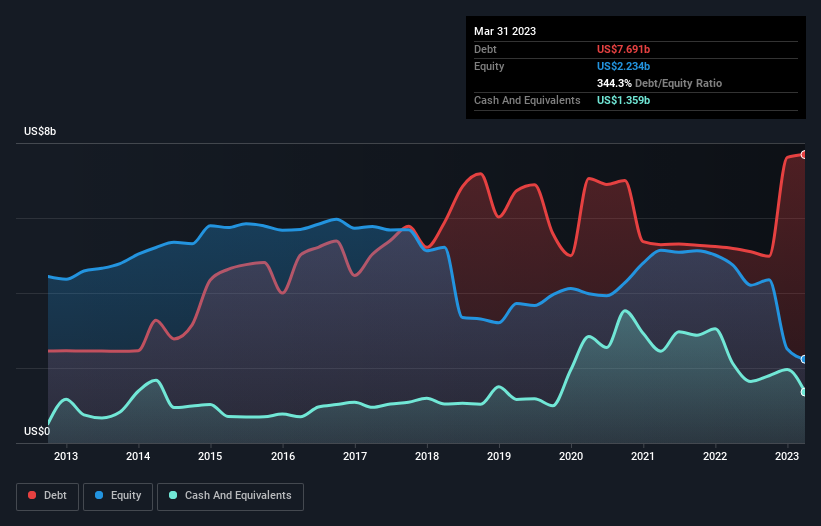

Further, Whirlpool Corporation said it expects to use transaction proceeds to reduce debt levels, which will enhance balance sheet flexibility.

“Proceeds expected to be used for debt repayment are incremental to the $500 Million term loan repayment that the company previously disclosed it expects to pay in the fourth quarter of 2023,” it added.

How healthy is Whirlpool’s balance sheet?

According to the last reported balance sheet, Whirlpool had liabilities of $5.93 Billion due within 12 months, and liabilities of $8.69 Billion due beyond 12 months.

Offsetting these obligations, it had cash of $1.96Billion as well as receivables valued at $1.56 Billion due within 12 months. So it has liabilities totalling $11.1 Billion more than its cash and near-term receivables, combined.

Given this deficit is actually higher than the company’s market capitalisation of $7.71 Billion, we think shareholders really should watch Whirlpool’s debt levels, like a parent watching their child ride a bike for the first time.

Hypothetically, extremely heavy dilution would be required if the company were forced to pay down its liabilities by raising capital at the current share price.

Any company’s debt load is measured relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortisation (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover).

The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Whirlpool’s debt is 3.2 times its EBITDA, and its EBIT cover its interest expense 6.9 times over. Taken together this implies that, while we wouldn’t want to see debt levels rise, we think it can handle its current leverage. Shareholders should be aware that Whirlpool’s EBIT was down 44% last year.

If that decline continues then paying off debt will be harder than selling foie gras at a vegan convention. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine Whirlpool’s ability to maintain a healthy balance sheet going forward.

Did high-tech competition end Whirlpool’s legacy in India?

Whirlpool of India Ltd. has been steadily losing market share over the past few months impacted by rising commodity costs and stiff competition from private-label peers, according to Emkay Global Financial Services.

In the refrigerator segment, the company has been the biggest loser with a 160-basis-point share loss year-to-date, the brokerage said in a September 8 report, citing its checks across retail distribution channels. “It has consistently lost share since March 2022 on a month-on-month basis.” LG and Godrej, according to Emkay, are the gainers.

Godrej’s market share in the refrigerator segment has consistently sustained over 9% since April. Tail brands such as BPL, Kelvinator and other private labels are the “major” gainers. Share of Voltas Beko’s was stable at 2.5%. Lloyd, albeit on a very small base, is also gradually seeing traction, it said.

Samsung, Haier, Bosch, and other tail brands gained share. Share of Voltas Beko and Lloyd was stable at 2.3% and 1.3%, respectively, Emkay said. Overall, however, the category has seen a contraction of 500 basis points in combined market share of the top five brands, which Emkay attributed to rising competition from private labels.

In a post-earnings conference call, Whirlpool acknowledged that inflation has peaked and its impact on consumer spending, especially entry segment, is putting stress on demand. It expects the short-term external environment to remain volatile.