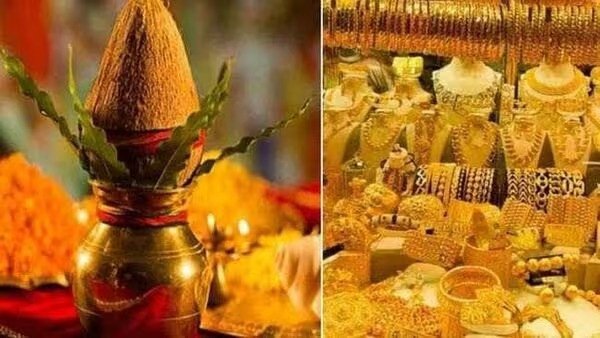

The trend of buying gold on Akshaya Tritiya in India holds deep cultural importance, intertwining tradition with contemporary investment practices. Akshaya Tritiya, an afternoon synonymous with auspicious beginnings and perpetual prosperity, is widely known across India with fervor and reverence. The term “Akshaya” itself embodies the idea of never-lowering, symbolizing the perpetual boom and abundance associated with these days.

Rooted in non secular beliefs and cultural customs, it is taken into consideration an opportune time for numerous endeavors, which includes starting a new business, embarking on a adventure, or making significant investments. Among those endeavors, the act of purchasing gold stands out as a time-venerated way of life deeply ingrained in Indian society. Beyond its ornamental cost, gold is regarded as a store of wealth and a image of economic protection.

For generations, families have marked Akshaya Tritiya by using shopping gold in various paperwork, be it rings, cash, or bars. This practice now not simplest reflects a cultural attachment to the metallic however also underscores its function as a tangible asset that transcends generations. The act of gifting it throughout weddings, fairs, and different auspicious activities further reinforces its cultural significance and enduring attraction.

In latest years, Akshaya Tritiya has developed past a trifling cultural tradition right into a considerable investment possibility. With the growing recognition of gold as an investment asset, many individuals now view Akshaya Tritiya as a super time to diversify their funding portfolios via allocating finances to gold. This convergence of lifestyle and investment method highlights the enduring relevance of gold in Indian society and its ability to conform to changing monetary landscapes.

Gold Price Trends and Investment Potential

Gold prices experienced a slight decrease on Friday, with the cost of 24 carat gold dropping to Rs.7321.8 per gram, down by Rs.75.0, and 22 carat gold to Rs.6706.8 per gram, down by Rs.68.0. Over the last week, there has been a decrease of -0.76% in the price of 24 carat gold, while over the last month, the change has been 0.12%. However, on the current day, rates of 10g of 24k gold (99.9%) is 73,560.00 – can surge more due to falling US dollar rates and increased domestic demand.

The historical fashion of gold prices round Akshaya Tritiya underscores its funding ability and splendor to investors. Traditionally, gold prices have exhibited balance or shown an upward trajectory for the duration of this era, driven by way of multiplied call for fueled by using cultural and religious sentiments. This fashion presents a compelling possibility for investors to capitalize on capacity charge appreciation and shield their wealth against monetary uncertainties.

Gold’s function as a secure-haven asset and a hedge in opposition to inflation in addition enhances its funding appeal, especially in the course of instances of market volatility. Unlike other assets susceptible to marketplace fluctuations, gold gives buyers a dependable method of keeping capital and diversifying their investment portfolios. This balance, coupled with the ability for lengthy-term growth, positions gold as a compelling funding choice for both seasoned buyers and newcomers alike.

Comparing returns from preceding Akshaya Tritiyas, gold has continuously introduced favorable returns, regularly outperforming key benchmark indices which include the Nifty 50 and Sensex. This historic performance underscores the resilience and enduring price of gold as an investment asset, similarly reinforcing its reputation as a preferred choice among traders in search of to shield and grow their wealth.

ALSO READ: Akash Anand removed as National Coordinator of BSP

This Akshaya Tritiya offers Diversified Investment Options

Investors have a myriad of options in terms of making an investment in gold, starting from traditional bureaucracy inclusive of jewelry and cash to fashionable gadgets like exchange-traded funds (ETFs) and virtual gold. Each investment option offers its personal set of advantages and considerations, making it essential for investors to conduct thorough studies earlier than making funding choices.

For the ones seeking bodily ownership of gold, alternatives such as jewelry, cash, and bars offer tangible belongings that may be held and saved securely. However, buyers have to don’t forget elements which include purity, craftsmanship, and garage costs whilst evaluating those options. Additionally, liquidity may also range relying at the form of gold selected, with rings frequently wearing higher rates and lower liquidity compared to cash or bars.

Alternatively, investors may opt for paper-primarily based investments which includes gold ETFs or sovereign gold bonds, which provide exposure to the prices without the need for physical ownership. These contraptions offer comfort, liquidity, and transparency, making them attractive options for investors seeking exposure to the markets.

Digital gold, every other rising funding choice, allows investors to buy and maintain gold electronically, supplying convenience and accessibility. While virtual gold systems provide ease of transaction and garage, investors ought to workout caution and conduct due diligence before committing budget to these structures, ensuring they align with their funding dreams and hazard tolerance.

ALSO READ: IPL 2024: LSG Owner Criticises Skipper KL Rahul after SRH Defeats LSG by 10 wickets

Precautionary Measures

Before making funding decisions, buyers must recollect factors together with their investment objectives, hazard tolerance, and time horizon. Conducting thorough studies, searching for recommendation from monetary professionals, and diversifying throughout special asset training can assist investors navigate the complexities of the market and make informed funding choices.

To sum up everything, Akshaya Tritiya affords a unique possibility for traders to participate in a time-commemorated way of life while additionally diversifying their funding portfolios. With its cultural significance, investment capacity, and numerous variety of investment options, gold continues to maintain a unique region in the hearts and portfolios of investors across India. By information the historical developments, funding concerns, and various options to be had, investors can harness the electricity of it to guard their wealth and pursue their financial goals with confidence.