COPENHAGEN, DENMARK : When Laima Springe-Janssen was looking to replace her French-made gasoline-powered SUV with an electric car, she considered models from Volvo and Nissan. The Volvo extras she wanted would have busted her budget, while the Nissan lacked the “wow factor.” The Copenhagen, Denmark, resident ended up buying a compact SUV from China’s BYD. “I really, really love the car,” Springe-Janssen said. For the equivalent of about $50,000, the Atto 3 SUV came with “all these goodies” like a 360-degree dash cam, two years of free charging and an extra set of winter tires. Her husband likes it so much he’s considering buying another BYD to replace their other car, from Volkswagen’s Skoda brand. “I’m sorry, Europe. Go home,” she said. “China has a better offer.” Her enthusiasm clearly showcases how much trust the Chinese automobile makers have gained from their European customers.

This Sept. 29, 2023 photo provided by Laima Springe-Janssen shows her posing by her electric car, from Chinese auto brand BYD, in Gelsted, Denmark. Chinese automakers are winning over drivers as they make major inroads into Europe’s electric vehicle market, challenging long-established homegrown brands in an industry that’s key to the continent’s green energy transition. The European Union has launched an investigation into Beijing’s support for its EV industry, adding to tensions between the West and China. (Sjoerd Janssen via AP)

This Sept. 29, 2023 photo provided by Laima Springe-Janssen shows her posing by her electric car, from Chinese auto brand BYD, in Gelsted, Denmark. Chinese automakers are winning over drivers as they make major inroads into Europe’s electric vehicle market, challenging long-established homegrown brands in an industry that’s key to the continent’s green energy transition. The European Union has launched an investigation into Beijing’s support for its EV industry, adding to tensions between the West and China. (Sjoerd Janssen via AP)

The competitive threat in the automobile sector has spurred the European Union to launch an investigation into Beijing’s support for its EV industry, according to reports the Chinese EV industry have quadrupled their profits within the last few years; even though profits are not the real concern for the EU, its the budget efficiency that the Chinese provide. That adds to tech-related tensions between the West and China, which is one of Europe’s biggest trading partners and the world’s biggest auto market.

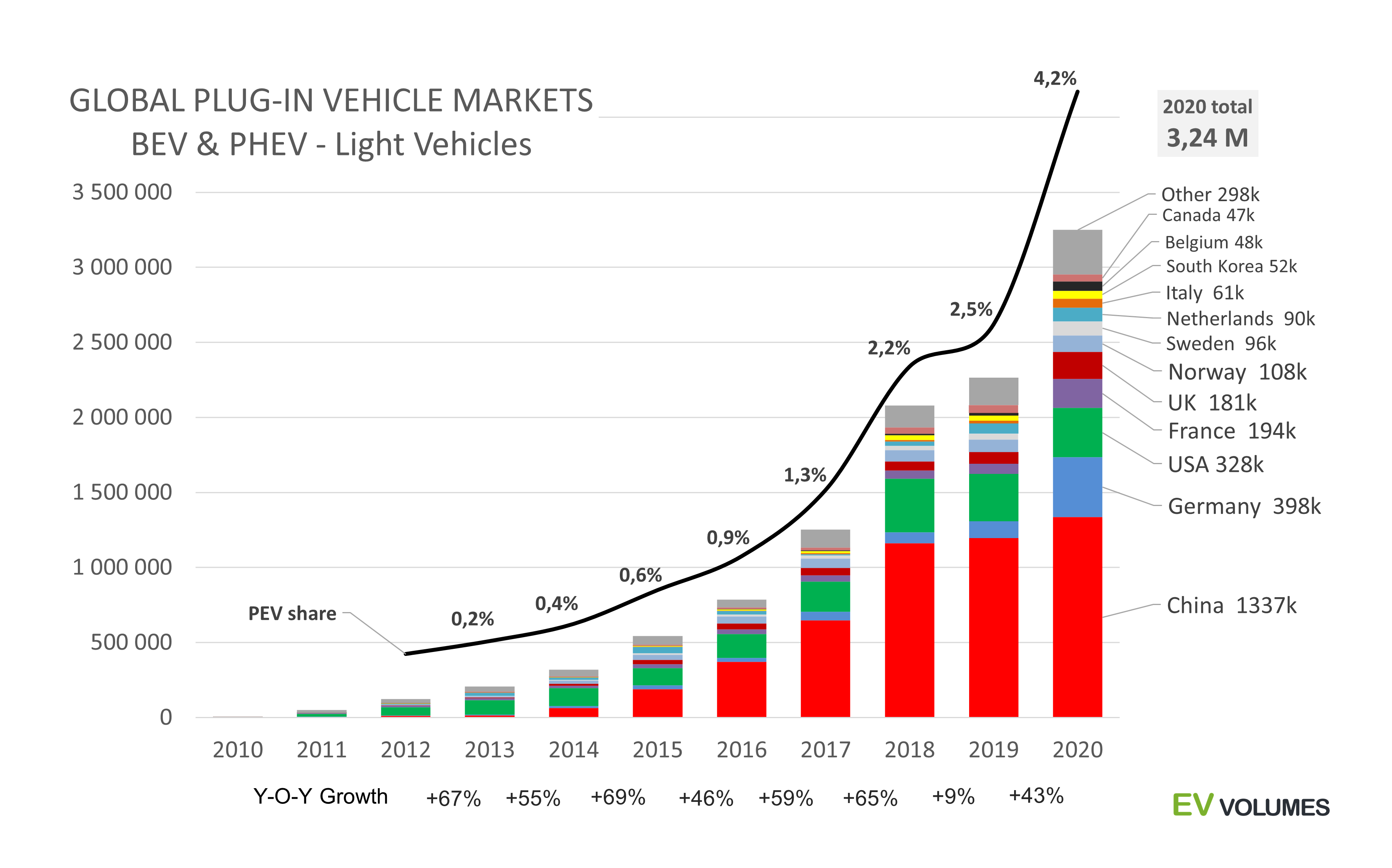

Source: EV VOLUMES

Source: EV VOLUMES

China’s EV onslaught, along with massive U.S. clean energy funding that has drawn investment away from Europe, shows how the 27-nation bloc is caught in the middle of the global race for green technology. Chinese EV makers are drawn to Europe because auto import tariffs are just 10% versus 27.5% in the U.S., independent auto analyst Matthias Schmidt said. Even after having the second biggest EV battery market, Europe has fallen miles behind this growing Chinese market in their own soil.

Climate-conscious car buyers in Europe who are grappling with an increased cost of living rave about how Chinese EVs are affordable yet packed with features and stylish design. Concerns about the threat to local carmakers and jobs just aren’t a factor for them. The increasing PPP (Purchase Power Parity) in Europe first led the buyers to buy EVs to save handsome amount of money in fuel. Soon, the customers understood the price difference between European EVs and the Chinese EVs. The difference in price was massive.

Chinese automakers account for only about 3% of Western Europe’s overall car market but 8.4% of the EV market, up from 6.2% last year and almost nothing in 2019, according to Schmidt’s data. This huge surge has created tensions for the European carmakers especially in France and Germany where millions of employees are working in this cut-throat competition between Europe and China.

The commission, the EU’s executive arm, formally opened its investigation this month, saying it would take up to 13 months and could result in import duties. Beijing voiced “strong dissatisfaction” and vowed to “firmly safeguard“ Chinese companies’ rights. The Chinese Commerce Ministry said the EU probe is based on “subjective assumptions,” lacks enough evidence and goes against World Trade Organization rules.

NIO’s founder and CEO, William Li speaks near the ES6 during an interview at the Auto Shanghai 2023 show in Shanghai, Tuesday, April 18, 2023. Chinese automakers are winning over drivers as they make major inroads into Europe’s electric vehicle market, challenging long-established homegrown brands in an industry that’s key to the continent’s green energy transition. The European Union has launched an investigation into Beijing’s support for its EV industry, adding to tensions between the West and China. (AP Photo/Ng Han Guan, File)

The statistics which have been brought forward after the Laima-Springe Janssen incident is nothing but an area of concern for the European Union. Every 3 out of 5 European choses his second car to be a Chinese manufactured car or a Chinese EV. The sole cause of this monopoly has nothing to do with the quality or features provided but the price efficiency. MG — owned by SAIC Motor, China’s biggest automaker — is the largest Chinese EV player in Europe. BYD, backed by American Billionaire Warren Buffet, is growing fast. There’s also Geely, which owns Sweden’s Volvo and a stable of EV brands including Polestar, Lynk & Co. and British sports-car maker Lotus. Behind them are a slew of startups, like NIO and Xpeng. Their combined sales are a sliver of the 9.2 million vehicles sold in Europe every year, but they have been gobbling up a piece of the smaller EV market at an astonishing pace.

Adding salt to the wounds, leading car-makers built vehicles in China have exported more than 1,60,000 units to Europe. This includes, BMW’s iX3 SUV made in northeastern Shenyang and Tesla’s Model 3 and Y produced in Shanghai, according to Schmidt’s data. That means one in every five EVs sold in Europe is a Chinese import.

The famous automobile company owner Stellantis profoundly known for owning French car companies like Puegeot and Citroen as well as Italian made cars like Alfa Romeo and Fiat is desperate to fight back against the Chinese competition. In a recent earnings call, CEO Carlos Tavares said the world’s No. 3 automaker is responding to a “Chinese invasion in a European market” with a new Citroen e-C3 cheap compact.

Beijing does not want to stop here as they are optimistic enough of “shaking up the European Market” by adding super-cars at cheap rates. BYD, Nio, Xpeng all plan to add sleek looking EV cars to disrupt the car market.

Reuters

This Sept. 29, 2023 photo provided by Laima Springe-Janssen shows her posing by her electric car, from Chinese auto brand BYD, in Gelsted, Denmark. Chinese automakers are winning over drivers as they make major inroads into Europe’s electric vehicle market, challenging long-established homegrown brands in an industry that’s key to the continent’s green energy transition. The European Union has launched an investigation into Beijing’s support for its EV industry, adding to tensions between the West and China. (Sjoerd Janssen via AP)

This Sept. 29, 2023 photo provided by Laima Springe-Janssen shows her posing by her electric car, from Chinese auto brand BYD, in Gelsted, Denmark. Chinese automakers are winning over drivers as they make major inroads into Europe’s electric vehicle market, challenging long-established homegrown brands in an industry that’s key to the continent’s green energy transition. The European Union has launched an investigation into Beijing’s support for its EV industry, adding to tensions between the West and China. (Sjoerd Janssen via AP) Source: EV VOLUMES

Source: EV VOLUMES