China’s real estate woes continue to grow with Country Garden becoming the latest realty firms deemed for default. What really is the China’s Real Estate Crisis?

China’s Real Estate Crisis and it’s significance

For many decades now, China’s economy have been dependent on a booming real estate sector fuelled by population growth. The construction business added many jobs and improved the economy gradually. Local governments also depended on revenue from land sales. But the country’s population is not growing the way it did earlier, and years of strict Covid-19 restrictions shook Chinese consumers.

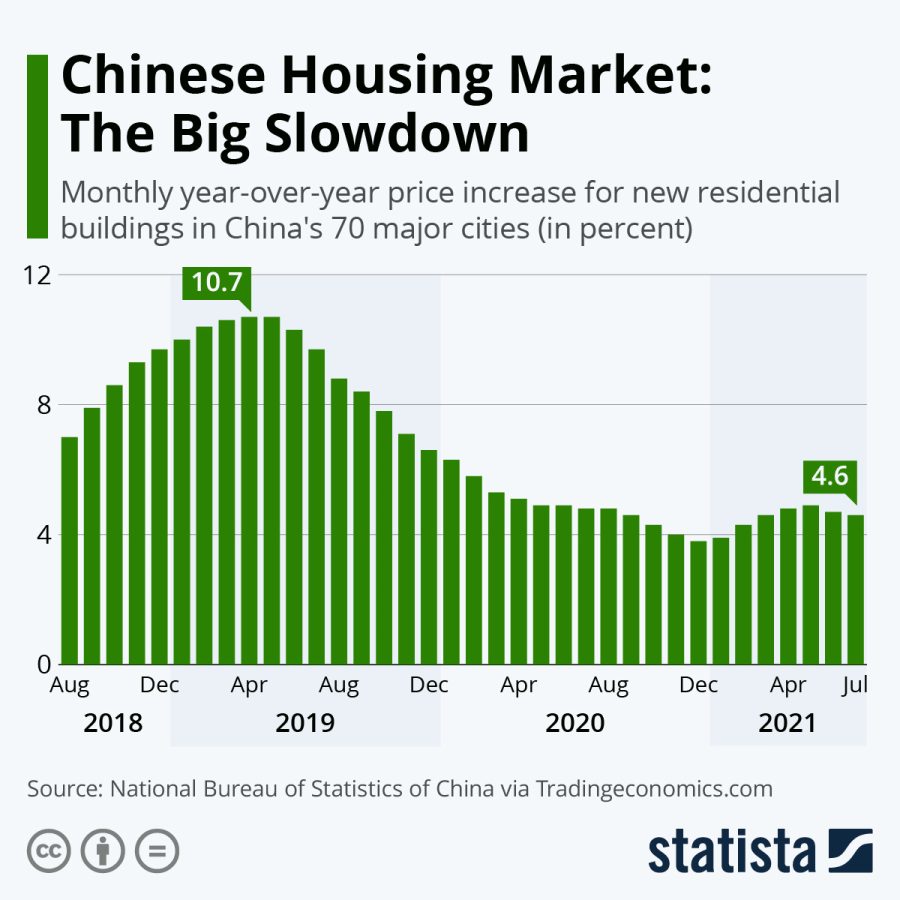

The government has also cracked down on risky practices in the industry, a combination that has left real estate developers with enormous debt and more new housing units than buyers. Home prices have slumped, denting Chinese households’ savings, and confidence, as the government tries to transition from an economy powered by state-directed investments and exports to one led by domestic consumer spending.

China’s Real-Estate industry could be under recession if the defaults continue to flow in this way. By one estimate from Gavekal Research, unpaid bills from private Chinese developers total $390 billion, a major threat looming over the economy. Both imports and exports have fallen in recent months, and foreign investment into the country dropped more than 80 percent in the second quarter from a year earlier. All the economic problems have hit the Chinese Economy’s hull all at same time. The main companies centred at the this crisis are Country Garden Holdings, the most recent one and Evergrande who are deemed default the previous year.

PEXELS

PEXELS

China’s biggest private property developer Country Garden is believed to have become the latest property giant to default on its overseas debt. The firm has $11 Billion in debt and another $6 Billion in onshore loans, and a default would mark one of the country’s biggest corporate debt restructurings. The reason of possible default for Country Garden dates back to the post-pandemic recovery era. In August, the crisis-hit Country Garden reported $6.7 Billion loss for the first six months of the year. If its default is confirmed, Country Garden’s offshore creditors will begin negotiations with the firm’s financial advisors to start a restructuring process which could take up a lot of time, considering the amount of debt. The announcement, made on the Hong Kong Stock Exchange, is effectively a statement from Country Garden, once China’s largest homebuilder, that it is likely to default with roughly $187 billion in liabilities.

Country Garden’s City Mansions project, in Nantong, China. The New York Times.

How did Country Garden fall into this pit of crisis?

The failure of Country Garden to pay a bond coupon has prompted an investor to start pushing for a payout on derivative financial contracts known as credit default swaps (CDS) linked to the troubled Chinese developer. Contry Garden did not pay the bond coupon after a 30-day grace period expired on October 18, according to media reports. The company has remained silent about it, and was later forced to deny online rumours that key members of the founding family had fled the country. Country Garden had about ¥118.5 Billion of foreign-currency debt on June 30, based on its latest financial report to shareholders. About $557.5 Million of offshore interest and principal maturities, as well as some $1.75 Billion of principal, will fall due by the end of this year, according to CreditSights, a US-based credit research company.

Country Garden Holdings Chairman and Executive Director Yeung Kwok-Keung. Reuters.

About Evergrande Crisis?

Evergrande, one of the most indebted property builder last month announced its bankruptcy after being under more than $300 Billion debt. In a filing with the Hong Kong Stock Exchange, Evergrande announced on Thursday that Hui Ka Yan, the company’s chairman and billionaire founder, was suspected by the authorities of criminal wrongdoing. The statement seemed to confirm news reports that Mr. Hui was under police surveillance, a form of house arrest, by the Chinese authorities. Once a renowned business company in China , Evergrande paid the price for years of heedless borrowings after the Chinese government cracked down on debt to limit the potential systemic risk from a property crisis.

A housing complex in Wuhan that was being built by China Evergrande. Getty Images.

How did Evergande land in this mess?

The sudden surge of success because of China’s rapid urbanisation saw the creation of Evergrande by the founder, Hui Ya Kan. Like other Chinese real estate companies, Evergrande’s business model was close to perfection when the tide was on their side. It borrowed to build, then repaid the debt when home buyers invariably snapped up property. The growth fuelled more debt and soon they were under $81 Billion debt in 2021-22 and now have surpassed the $300 Billion debt mark. It soon branched out from real estate and built cars, operated other businesses and soon bought a football club. In 2020, regulators made it more difficult for indebted real estate companies to continue borrowing. Evergrande’s business model — fuelled by easy access to credit — crumbled.

What happens to the Chinese Economy?

The Chinese governance did subsidise a lot of real estate companies to avoid this kind of reckless business activities. Incentives and help was launched by the ministry for a few companies. Unfinished homes and more than 50 real estate developers in defaulters list is nothing but worrisome for Beijing. The real estate industry has contributed significantly to China’s ‘economic miracle’, averaging 13.4 per cent of GDP since 2013. According to a Stanford University report, the sector ‘has remained around 26 per cent of GDP since 2018’ — a high portion by both international and domestic standards.

China’s robust growth, one of the fastest sustained expansions for a major economy in history, was propelled for decades by a housing boom fuelled by a rising population and urbanisation. Investment in real estate fell last year for the first time in a decade, and with no bailout from Beijing in sight, the property downturn is likely to drag on, posing a major threat to China’s growth prospects over the next three to five years.

The woes continue for Xi-Jin-Ping. Weaker economic growth, all time high youth unemployment and hints of recession have all hit Beijing together. The bankruptcy of these companies leave the government with nothing but pennies in their hand. This catastrophe is expected to hurt the Chinese GDP by 3-4% YoY. Is there a way out from this crisis? or is it the beginning of the downfall for China?