Nike and Adidas, the two huge multi-national sports and apparel companies are allegedly facing challenges in their Chinese business. sources have also said that both the companies would be willing to leave Beijing if need be for better performances.

NIKE’S SUPPLY CHAIN ISSUES

Nike Inc. said it’s reviewing its supply chain in China to assess potential risks involving workers from the country’s Uighur Muslim minority after allegations of forced labor.

A Washington Post story last month described the plight of ethnic Uighurs from China’s western Xinjiang region, who were detained and sent to factories that produce athletic gear. A report by the Australian Strategic Policy Institute also estimated that more than 80,000 Uighurs were sent to work in the supply chains of a range of well-known global brands including Nike “under conditions that strongly suggest forced labor.”

The Trump administration has repeatedly criticized China for what the United Nations says is the detention of as many as 1 million mostly Uighur Muslims. Nike has also become a target, with Vice President Mike Pence last year citing the company as an example of an American multinational “that willfully ignores the abuse of human rights” in China.

China’s foreign ministry earlier this month called the reports about forced labor “simply baseless” and designed to “smear China’s counter-terrorism and de-radicalization measures in Xinjiang.” Late last year the government said it completed what it called de-radicalization training and that the “students” had all “graduated.”

In a statement on its website, Nike said that while it does not “directly source products from the Xinjiang Uighur Autonomous Region,” the company was looking into how suppliers rely on Uighurs elsewhere.

“We have been conducting ongoing diligence with our suppliers in China to identify and assess potential risks related to employment of people from XUAR,” the company said. “Nike is committed to upholding international labor standards and we are continuing to evaluate how to best monitor our compliance standards in light of the complexity of this situation.”

The Beaverton, Oregon-based company said it’s working with trade groups such as the Retail Industry Leaders Association, American Apparel & Footwear Association and National Retail Federation, and stands behind a statement they released on Tuesday.

“As an industry representing brands and retailers, we do not tolerate forced labor in our supply chains,” the groups said in the letter.

ADIDAS’S STRUGGLES IN CHINA

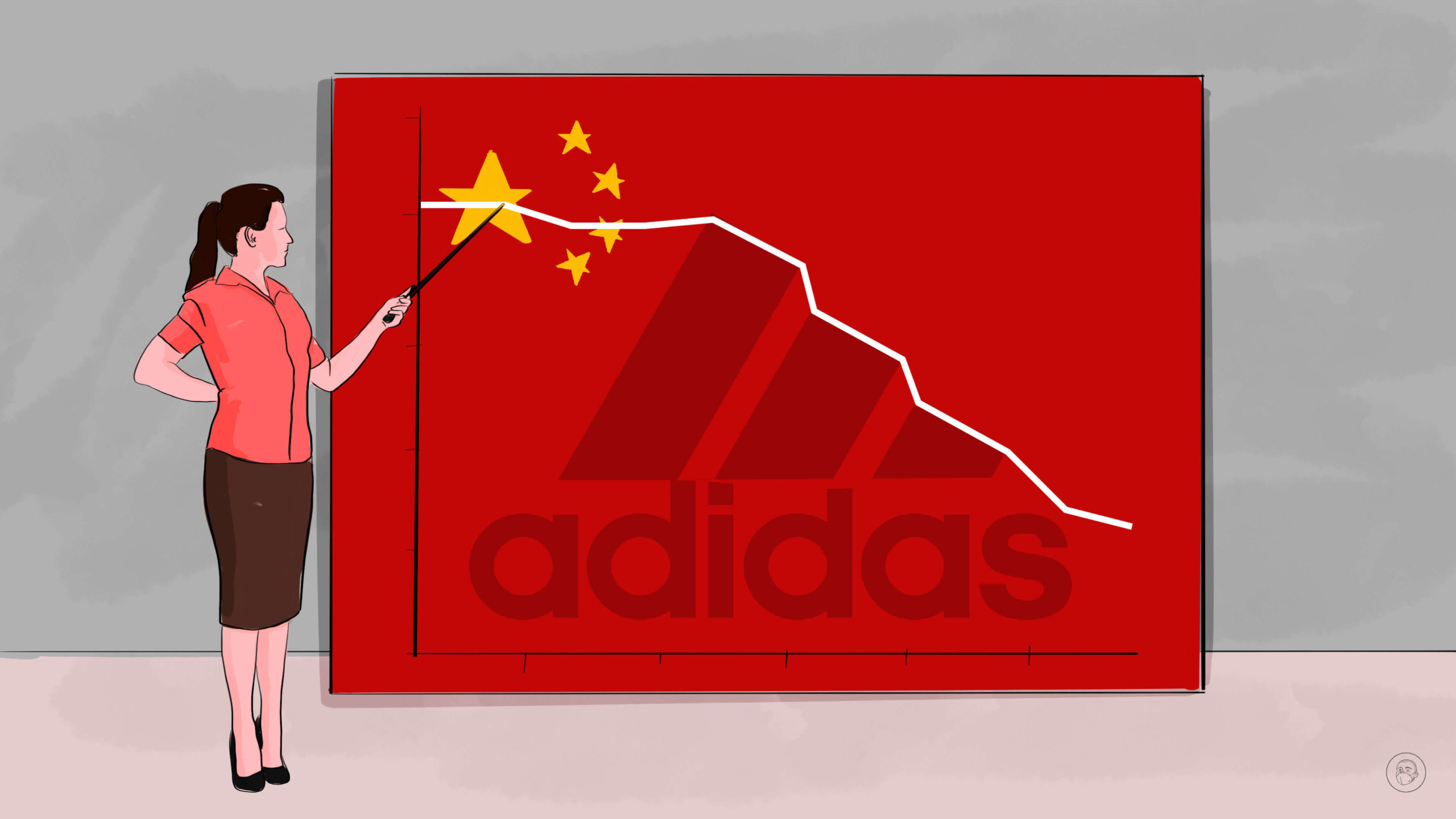

For the 12 months ended 31 December 2022, Adidas saw earnings slide 83% to €254 Million ($268M), partly a result of one-off costs amounting to €350 Million related to the wind-down of its Russia business, a legal dispute, inflation and restructuring.

Gross margin narrowed to 47.3% from 50.7% a year earlier. Adidas blamed a strong increase in supply chain costs reflecting increased product costs and freight expenses. In addition, higher discounts, particularly in the second half of the year, a less favourable market, category, and channel mix as well as negative currency developments weighed on the result.

Sales, meanwhile, were down 6% to €22.5 Billion, impacted by the termination of Adidas’ partnership with the Yeezy’s. On a currency-neutral basis, sales were up 1% reflecting growth in all markets except Greater China. The sportwear retailer saw growth in both wholesale (+1%) and the company’s own direct-to-consumer (DTC) business (+2%).

From a market perspective, currency-neutral sales grew at a double-digit rate in Latin America (+44%) and North America (+12%). Revenues in EMEA were up 9%, and sales in Asia-Pacific grew 4% in 2022. In Greater China, however, revenues declined 36% due to the “challenging market environment, company-specific challenges as well as significant inventory takebacks”.

For the current financial year, Adidas is expecting currency-neutral revenues to decline at a high-single-digit rate, and reported operating loss to be €700 Million.

German sportswear giant Adidas saw its share price drop this morning (8 March) after revealing what analysts have described as “disappointing” full-year results on the back of a “catastrophic” performance in China.

THE CHINA PROJECT

THE CHINA PROJECT

Why are companies facing challenges in China?

Foreign companies are shifting investments and their Asian headquarters out of China as confidence plunges following the expansion of an anti-spying law and other challenges, a business group said Wednesday.

The report by the European Union Chamber of Commerce in China adds is one of many signs of growing pessimism despite the ruling Communist Party’s efforts to revive interest in the world’s No. 2 economy following the end of anti-virus controls.

Companies are uneasy about security controls, government protection of their Chinese rivals and a lack of action on reform promises, according to the European Chamber. They also are being squeezed by slowing Chinese economic growth and rising costs.

Business confidence in China is “pretty much the lowest we have on record,” the European Chamber president, Jens Eskelund, told reporters ahead of the report’s release.

President Xi Jinping’s government, trying to shore up economic growth that sank to 3% last year, is trying to encourage foreign companies to invest and bring in technology.

China’s minister of commerce, Wang Wentao. GETTY IMAGES

But they are uneasy about security rules and plans to create competitors to global suppliers of computer chips, commercial jetliners and other technology.

That often involves subsidies and market barriers that Washington and the European Union say violate Beijing’s free-trade commitments.

Another huge problem faced by the companies is the Chinese culture. Not all kind of products suit the culture as they are very rigid. This is results in poor sales in their region.

Companies also are uneasy about Beijing’s promotion of national self-reliance. Xi’s government is pressing manufacturers, hospitals and others to use Chinese suppliers even if that raises their costs. Foreign companies worry they might be shut out of their markets.

Reuters

Reuters

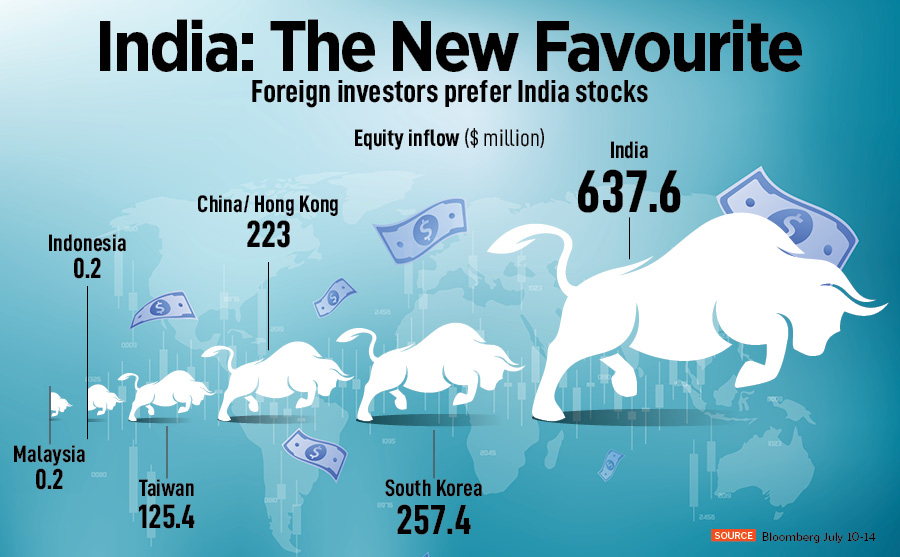

In the European Chamber survey, the top destination for companies moving their Asian headquarters out of China was India with 28%, followed by Singapore with 15% of companies. Only 9% went or plan to go to Hong Kong.

Conclusion

Billions of dollars are flowing out China and there is very little the Government is able to do about it. China’s struggles keep on adding from real-estate crisis to economic woes and now companies opting to shift their Asian headquarters. Nike & Adidas are not the first companies to leave China as Apple already did that by shifting in India.

With the world’s largest population at its disposal, China was also able to offer investors a cheap labour force with diverse skillsets, a key attribute for companies seeking large-scale manufacturing investments. China’s economy continued to thrive and experienced little competition from neighbouring countries for several decades. In recent years, however, political disputes and on-going sanctions have seen international companies wary of investing in China, and the country has witnessed a decline in Foreign Direct Investments (FDI).

The problems could get worse as even now every 1 out of 3 Chinese youth are unemployed; the outside flow of money and companies could worsen the situation.

With difficult business conditions in China, is India on the way to become the number 1 choice for companies to set their Asian headquarters?

million and around one-third of it into China (see table).

THE CHINA PROJECT

THE CHINA PROJECT

Comments 1