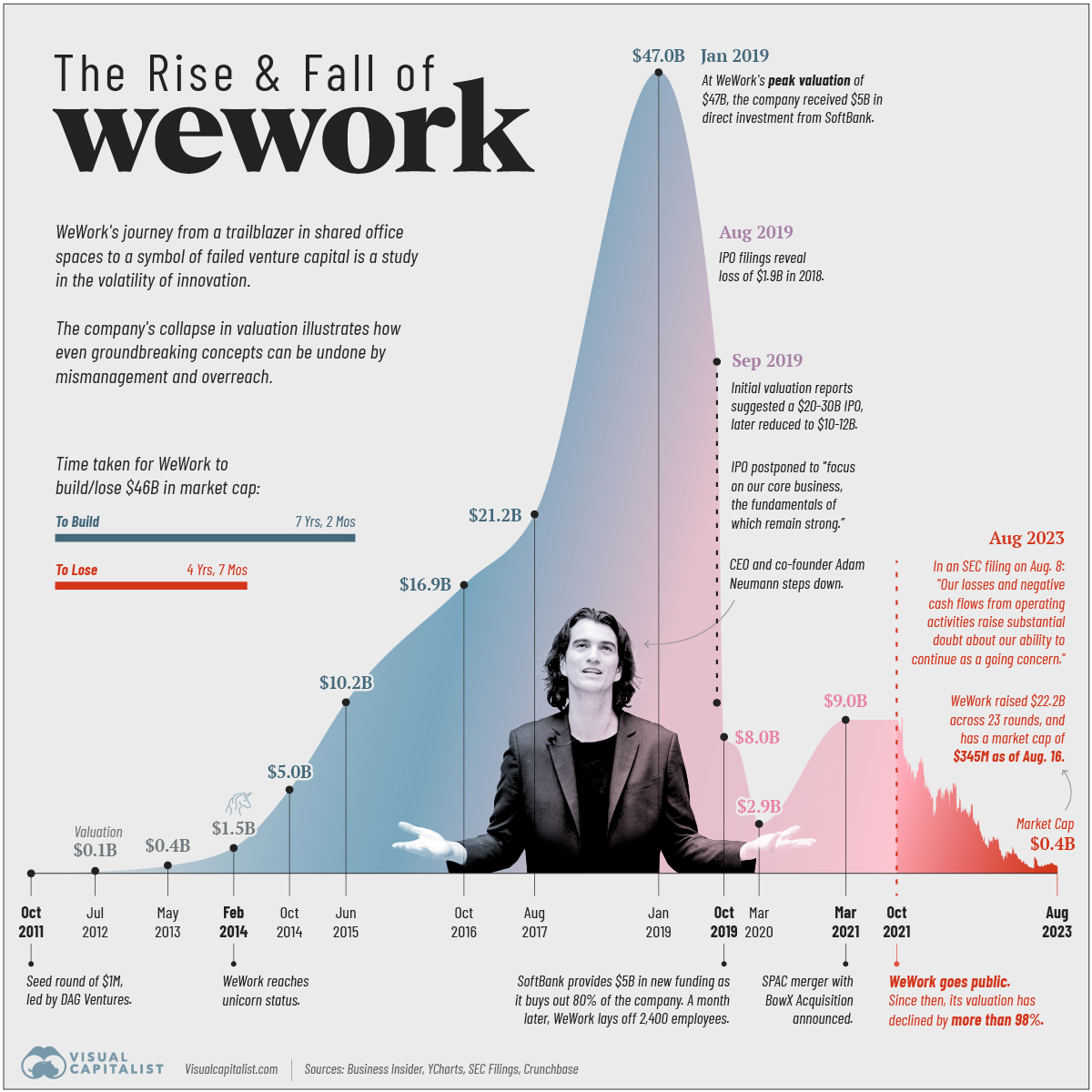

WeWork, the shared office firm that was once valued at $47 Billion has its hands tied and has filed for bankruptcy.

The decision follows the meteoric rise – and fall – of a company which was once seen as the future of the workplace.

David Tolley, WeWork’s chief executive, said he was “deeply grateful for the support of our financial stakeholders as we work together to strengthen our capital structure and expedite this process through the restructuring support agreement”.

More about WeWork

WeWork was founded in New York by Adam Nuemann in 2010 with a goal to offer co-working spaces to entrepreneurs, startup companies, freelancers, and even larger enterprises. It became known for offering beer on tap in its offices as well as colourful and relaxed decor.

The company grew rapidly since its establishment, making it one of the largest and most visible co-working chains in the world. It now has thousands of employees and over 800 locations worldwide, including outposts in 40 of USA cities and 32 countries, like Brazil, Germany, India and Thailand.

The company’s investors have included a number of global entities, including holding conglomerate SoftBank, private equity firm Hony Capital, and real estate developer Greenland Holdings. In August 2017, SoftBank and its founder, Masayoshi Son, poured a massive $4.4 Billion as investment into WeWork.

This included $3 billion for the company itself, namely through primary investment and the purchase of existing shares, and $1.4 billion dedicated to the company’s expansion into the Asian market. In August 2018, they announced yet another $1 billion in funds from SoftBank.

In a nutshell, WeWork rents buildings from property owners at one price and then rents them out to clients at higher prices. Not all of the locations it uses are similarly priced; buying up real estate in Baltimore or Nashville, for example, is cheaper than in New York City. These price discrepancies help keep WeWork’s overhead from getting too high.

After renting the buildings, the company transforms them, updating everything inside and adding features like cafés, offices, and community spaces. Once finished, the company rents out the spaces for significantly higher prices. Apart from making money on rent, they also provides additional services for a fee, such as partnerships with local businesses, car rentals, and other à la carte amenities.

What went south for WeWork?

GETTY IMAGES. WeWork co-founder and boss Adam Neumann

GETTY IMAGES. WeWork co-founder and boss Adam Neumann

WeWork valuation reached $47 billion after a funding round led by Masayoshi Son’s SoftBank back in 2019. But it suffered one of the most dramatic corporate failures in recent US history.

Its downfall began with a failed initial public offering (IPO). In August 2019, the USA-based company filed to go public, but the IPO documents exposed its unprofitable business model, conflicts of interest and a bizarre management style, reported CNBC.

Company’s CEO Adam Neumann had a number of conflicts of interest, such as renting out company space to his own businesses and selling his WeWork stocks at a higher price to SoftBank, according to Business Insider.

Neumann, who had a reputation for being an eccentric and demanding CEO, was also known for his lavish lifestyle that included spending millions on a private jet and a yacht.

Investors were spooked by these revelations and the IPO plan was eventually called off. Neumann was ousted as CEO and the company was forced to make drastic cuts.

The company was already facing a cash crunch, and it didn’t have enough revenue to support its business. In October 2019, WeWork was forced to accept a bailout from SoftBank.

The pandemic next year made things worse as several companies abruptly ended their leases due to the emerging work-from-home (WFH) model. The economic slump that followed led even more clients to close their doors.

The company debuted through a special purpose acquisition company in 2021, but has since lost about 98% of its value.

In mid-August, WeWork announced a 1-for-40 reverse stock split to get its shares trading back above $1, a requirement for keeping its New York Stock Exchange listing.

They disclosed in an August regulatory filing that bankruptcy could be a concern. It downfall is a cautionary tale about the dangers of hype and overvaluation of the startups. It is also a reminder that even the most successful companies can fail if they have a weak business model and poor management.

The Chapter 11 of USA Bankruptcy code under which WeWork has filed for Bankruptcy

A case filed under Chapter 11 basically helps the debtor to still be in control of the organisation. Company can still be operated, new money can be borrowed and the trustee can still perform its positional duties.

A plan of reorganisation is suggested, creditors whose have an conflict of interest may vote on the plan, and the plan may be confirmed by the court if it gets the required votes and satisfies certain legal requirements.

The case usually starts by a petition filed either by the debtor (in this case it is WeWork) or the creditors who meet a certain requirements.

How WeWork’s bankruptcy will impact the Indian arm of the USA-based company?

WeWork India on Tuesday said it operates independently and WeWork Global’s bankruptcy filing in the US will not impact its stakeholders in India. The bankruptcy filing allows it to keep operating as it chalks out a debt repayment plan.

“WeWork India is a separate entity from WeWork Global. The recent Chapter 11 filing will not impact our members and stakeholders in India. We will continue to operate and serve our members, landlords, and partners as usual. Committed to the growth and success of our business,” it said in a post on X, formerly Twitter.

They said it is backed by majority stake holder Embassy Group, and is committed to investing in the future of its business.

WeWork Inc went public in 2021, two years after its IPO failed amid investor concerns over valuation and growth prospects. Founder Adam Neumann had to resign as CEO following a fall in the company’s valuation.